Ask any CX, research, or marketing executive, and they will tell you that gone are the days when the customer marketing landscape was represented by a one-way dialogue for engaging prospects. Today, market leaders are shifting their listening and response mechanisms faster as VoC programs represent a huge opportunity for driving loyalty and increased sales.

Poor customer experiences result in an estimated $83 Billion loss by U.S. enterprises each year because of defections and abandoned purchases, and people are twice as likely to talk about a negative experience than they are a positive one.

Free eBook: IDC MarketScape for Voice of Customer Applications Report

Definition of Voice of the Customer (VoC)

The Voice of the Customer (VoC) is the capture of what customers are saying about a business, product, or service.

Voice of the Customer (VoC) is a term that describes your customer’s feedback about their experiences with and expectations for your products or services. It focuses on customer needs, expectations, understandings, and product improvement.

By listening to the Voice of the Customer, businesses can better understand and meet customer needs, expectations – and improve the product and service they offer. A Voice of the Customer program gives insight into customer preferences, problems, and complaints. These VoC programs identify and respond to the Voice of the Customer to improve customer satisfaction and loyalty.

Businesses capture the Voice of the Customer to use the data to improve how a customer experiences all interactions with the business. VoC is best understood using technology that includes text analytics and sentiment analysis because this ensures you can find meaning in the customer feedback data.

VoC programs have gained traction over the years and are fast-growing segments of a core business strategy for organizations. They work exceptionally well for brands as customers demand more direct engagement with a firm and because capturing and acting on customer feedback is critical to understanding a prospect’s complex decision-making process.

The benefits of a Voice of the Customer program

Businesses capture the Voice of the Customer to use the data to improve how a customer experiences all interactions with the business. VoC is best understood using technology that includes text analytics and sentiment analysis because this ensures you can find meaning in the customer feedback data.

By listening to the Voice of the Customer, businesses can understand and then meet their customers’ needs. A Voice of the Customer program gives insight into customer preferences, problems, and complaints, putting businesses in a better position to identify problems and opportunities so they can take the appropriate next steps.

How companies are changing the business landscape with VoC

Customer perceived quality and above-average customer service have been proven time and again to be leading drivers of business success. When your customers share their voice in real-time with your organization, they expect you to listen, act and report back to them on progress.

To win the war on customer loyalty you must have a single line of sight into your customer, market, and employee groups.

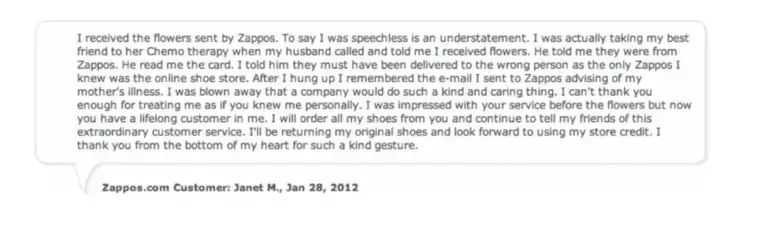

Zappos

Zappos is known for having exceptional customer service and they measure it by asking how the interaction with the employee made the customer feel. Zappos wants to know how the brand and customer experience emotionally resonates with customers.

Additionally, the company empowers their customer service representatives. Zappos employees are allowed to give “wow gifts” to customers. For instance, when one customer called to return shoes after her mother had fallen ill, the employee on the phone sent her flowers. The woman was shocked that Zappos actually cared about her personal life. That’s how they build lifelong customers.

Capture your customer feedback with our free customer satisfaction survey template

Building a successful voice of customer program

Before you jump in and begin building a step-by-step plan for achieving customer experience maturity, you’ll want to set the stage. Too often people rush into building a program without aligning all the necessary factors to move forward with creating a customer-centric organization.

By focusing on the following six factors, you can successfully establish organization-wide customer centricity.

ebook: How to build a best-in-class VOC program

Strong leadership

Establishing a customer-centric culture starts at the very top. Without executive-level buy-in there is a low probability of creating maximum impact for any customer-centric initiative. You’ll also want to garner the support of lower level leaders to truly move the needle on improving the customer experience. Leaders set the tone for their teams, so if a leader decides that the customer is important, their direct reports will follow suit.

Vision and clarity

Your vision for VoC needs to be specific so that everyone within the organization can easily understand the common goal. Start by focusing on the language and messaging you’ll use to convey your vision. We recommend a short and simple vision statement to help you increase understanding and buy-in from leadership.

Engagement and collaboration

An engaged workforce is vital for the long-term success of a customer-centric company. And as employees become more engaged, cross-functional collaboration and synergy will create more impactful and successful customer initiatives. To truly engage your workforce, you have to understand them. The most tried and true method for doing so is by implementing a formal employee experience program.

Listening and learning

A systematic method for monitoring and collecting customer feedback is key to improving the overall experience. Because customer feedback can be gathered via multiple channels it’s important to build any listening program on a robust platform that can to pivot with customers as their feedback preferences change.

Alignment and action

Alignment means that all members of a company are marching towards the same vision, and each workgroup defines what action they must to take to help realize that vision. Generally speaking, action refers to the measurable steps taken to improve the customer experience. A properly designed root cause or driver analysis will help you identify what areas to take action on.

Patience and commitment:

As much as it pains companies to hear this, building a world-class customer culture is not an overnight exercise – nor is it one that can be completely outsourced. Like it or not, the most successful customer-centric organizations in the world are built in an iterative fashion over a number of years. Customer culture is slowly altered, collection practices are refined, analyses are increased in complexity, and action becomes widespread and aspirational. All along this journey, leadership must demonstrate patience and commitment to the process and vision.

Free Download: The Ultimate Voice of the Customer (VoC) Starter Kit

3 questions to answer before building your voice of customer strategy

When deploying a voice of the customer (VoC) program, there are three critical questions to ask. These questions can guide your program design and the technology you need to support it. The questions are:

- What business objective do we want to achieve by deploying a VoC program?

- Given our strategic intent, what do we need to capture?

- Given our objectives and our information needs, what survey technology should we use?

Starting with the first and most important VoC question:

1. What business objective do we want to achieve by deploying a VoC program?

Your answer to this question dictates the other key questions you ask. VoC programs typically serve one of two distinct strategic objectives:

- Benchmarking

- Continuous improvement

Answer A: Benchmarking

Some survey vendors claim that their models serve both objectives, but you need only look at what they do (how they structure their surveys) rather than what they say. Benchmark-purposed surveys feature a multitude of ratings questions and the whole approach is metrics-heavy. One provider we’ve seen uses the first 13 questions to exclusively serve the need for benchmarking, and it is not uncommon to find a survey with perhaps one open-ended question in a 30- or 40-question set.

Because benchmarking is a comparative exercise, it is essential to have an “apples-to-apples” approach to the survey experience itself. This means serving up the same set of questions to every survey respondent, regardless of their actual pathway through the website. When done poorly, this can make for a long and not necessarily relevant exercise for the respondents. Brevity and relevance dictate response quality, so the longer and less relevant the survey questions, the lower the likely quality of the responses.

The value your benchmarking surveys deliver, therefore, point to comparative performance. Why your scores rank as they do will likely remain unclear, except at the level of general causality – “navigation,” for example, or “look and feel.” “Navigation” involves a multiplicity of variables, so you still need to conduct additional, granular research to get to the root cause.

Answer B: Continuous improvement

If your strategic intent is continuous improvement, your tactical objective is to understand causality. Ratings questions are useful, but their value rises exponentially if they are linked to follow-up questions designed to understand why the respondent rated that aspect of the site or visit as they did.

“Based on why you came here today, how successful was your visit?”

Followed up with:

“Please help us understand the main reason you were unsuccessful [or successful].”

Continuous improvement-purposed surveys, therefore, exhibit a much greater balance between ratings questions and open-ended questions. Answering an open-ended question takes much more effort on the part of the respondent, so the question set needs to be as concise and as relevant as possible. In other words, continuous improvement surveys should be tailored to the individual respondent, so that the questions reflect the visitor’s particular pathway through the site and take into account the visitor’s unique experience.

This ability to “customize” each set of questions to the individual respondent depends on having a survey technology capable of tracking visitor behavior and incorporating those details into a set of tailored exit questions.

“We noticed that you viewed the ‘What’s New’ section in Handbags. How appealing did you find our new designers?”

Followed up with:

“Please help us understand why the new designers struck you that way.”

There is obviously a limit to the number of times you can ask a respondent to elaborate on an answer, so be judicious about where, when, and what you ask for regarding explanatory information. In pursuit of continuous improvement, responses that help you understand why your visitors react to the various aspects of the site experience are gold. They provide a detailed, granular understanding of causality, and by identifying the root cause of a problem, you can fix it permanently.

Even though the shortest route to improvement is to eliminate common problems, it is also valuable to understand why visitors like positive aspects of their experience. Positives tell you:

- What to emphasize and expand

- What not to break when you go about fixing other problems

The second VoC question to ask is:

2. Given our strategic intent, what do we need to capture?

If your VoC strategy is aimed at benchmarking, the answers to this question are limited by the survey takers’ tolerance for responding to questions that may or may not be of much interest or relevance. Those questions yield trending metrics and ranking data parsed into as many sub-components as the survey can reasonably ask before the quality of the data comes into question (people responding mindlessly to the questions, just to get through the survey).

VoC teams focused on continuous improvement, however, have an opportunity to serve the interests of their internal customers at a much deeper level than can the benchmark providers. This is why we use the term “capture” rather than “ask” in how we phrase the second question. Intelligent survey technology can capture far more than the answers to survey questions. In the background, it can collect the pages visited, the categories or brands viewed, the products compared, or the tools used; it can monitor for events, such as abandoned carts, the creation of a wish list, or checkout abandonment.

This abundance of behavior can be used to trigger the type of experience-specific survey questions referenced above or to provide a full, detailed picture of the respondent’s site visit. The addition of behavioral data allows for much more sophisticated analysis, since the questions asked of the data can be triangulated via metrics, verbatim responses, and actual behavior. These analytical benefits can, to some extent, be replicated by integrating survey data into web analytics data. Since that is a post-processing data merge, however, it obviously precludes the ability to ask behaviorally-triggered questions during the survey itself. Post-process data merging therefore loses the “in the moment” contextual value of capturing the visitor’s reaction when it is immediate and at its most vivid point.

The ability to capture almost every aspect of a respondent’s visit opens up a vista of possibilities for your internal clients. Once you remove the constraints of “dumb” survey technologies, your clients are free to ask for data to address their real business challenges. Your survey strategy will allow you to accommodate needs as diverse as the client groups you serve.

- Executives typically want top-line visibility, such as trending data for NPS, systemic problems, or initiative-specific metrics.

- The online marketing team wants to know demographics associated with the primary acquisition vehicles; they want to know why visitors responded better to one promotion than another.

- The site search team wants to know specifics about visitor response to the reorganization and layout of the results page.

- The merchandising team wants to know why a brand favorite no longer converts at its previous high rates.

- The site architects want to understand how the new taxonomy in the Sale section is working for returning visitors.

- The Checkout team wants to know why conversion dipped when they added a Guest Checkout option.

The variations are endless. Yet the beauty of adding behavioral capability to your surveys means that you can enjoy the best of both worlds. You can capture contextual data that provides exceptional value and insight to your internal customers; at the same time, you can utilize that behavioral data to minimize the number of questions you ask of your respondents by asking them only questions relevant to their immediate site experience.

Your “master survey document” might have 50 questions (perhaps 10 common and 40 variable) and 30 behavioral events to monitor, but no survey respondent will ever see more than 20 questions. The question mix could be different for each one. You achieve sufficient volume of answers to the variable questions through experimenting with invitation rates.

The third VoC question you ask is:

3. Given our objectives and our information needs, what survey technology should we use?

The answers by now are obvious. If your VoC purpose is benchmarking, your need is simple and your survey technology can be basic, too. If, however, you embrace continuous website improvement and an obsession with understanding causality, your VoC strategy will best be served by a sophisticated platform, one with the ability to capture the entire visitor experience and frame each survey accordingly.

Voice of Customer program best practices

The Voice of the Customer provides early warnings and direction for your success, directly from the people who really matter—your customers. Employ these five “must-haves” to realize continuous improvement in your VoC program.

Connect feedback across data channels

Many organizations rely on one or two channels to measure and optimize their interactions with customers, which limits the accuracy and depth of customer insights. Without an omni-channel feedback tool, voice of the customer programs offer incomplete information about customer preference, behavior, and satisfaction. Additionally, leading brands and organizations want to collect customer feedback everywhere their customers are so they can create a more seamless customer experience.

Collaboration across departments with action planning

To create an effective VoC program, multiple departments must be involved in collecting, analyzing and acting on the insights. It should be easy to collaborate across departments using action planning tools — Qualtrics allows you to tag owners, set deadlines, and even supply step-by-step guidance to enable everyone to delight their customers.

Incorporate the voice of the employee

Connecting the employee and customer experiences gives any organization a complete picture of what is really going on and why. Understanding this connection will help your organization understand the impact of employee engagement on the bottom line.

Employees’ feedback does three essential things when it comes to customer experience. It:

- Provides context for customer experiences

- Helps identify process, policy, and technology hurdles that hinder experience delivery

- Gives insight into the quality of employees’ experiences.

Use dashboards and reports to surface insights to the right people

A true Voice of the Customer tool allows you to make sense of what’s going on in your business. You’ll want a platform that allows you to configure dashboards for every role and provides relevant insights for the right people to see.

Qualtrics allows you to create automatic actions and alerts based on location, responses, behaviors, department, role, and more. You can also loop in the right stakeholders automatically based on the feedback received from the leadership team to the frontline.

Deliver clear ROI and business results

Any successful customer experience program needs to deliver returns back to the business, so it’s essential to go in with an ROI mindset and focus everything from your measurements and metrics to the actions and improvements you put in place on what they’ll deliver back to the business.

ROI is not simply reporting on the VoC metrics like Net Promoter Score (NPS), Customer Satisfaction (CSAT), and Customer Effort Score (CES) but instead tying improvements in these metrics back to a financial metric.

That means focusing on:

- Market share — this includes optimizing market penetration by widening your appeal within your target market, increasing share of wallet by getting your customers to spend more with you than they do with your competitors and boost category spending by taking what your customers are spending in other areas and getting them to spend it with you instead

- Cost — every activity has a cost, so understanding the costs to serve, acquire and retain and weighing them up against the projected gains of any increase in those areas is an essential component. An improvement in one area may see an increase in retention, but if the cost of that activity is greater than the projected improvement on the bottom line, it’s not worth doing.

- Efficiency — typically a function of time which is whether it’s the total number of man-hours required to complete a task to satisfaction or the total amount of time from beginning to end.

As a result, Customer Lifetime Value (CLV) has become the premier financial metric in customer experience. This takes into account a whole range of individual metrics from share of wallet and market penetration to cost of acquisition and customer retention to provide a robust metric of ROI.

Focusing solely on a single metric like customer acquisition doesn’t take into account the other factors at play — for example an increase in your churn rate, nor the fact that at the start of the lifecycle, a customer is typically a cost to the business, meaning you won’t turn the cost to acquire into profit for the first 12 months.

Related: Learn everything you need to know about collecting customer feedback

Focus on the customer

The customer should be top of mind in everything you do and you can’t assume you know what your customer wants. In order to stay ahead of the competition and meet your consumers where they are, you have to listen to what customers are saying to you and about you, then act fast. And you can do that by establishing a proven Voice of the Customer program that collects, understands, and shares the Voice of the Customer knowledge your organization needs to make confident, customer-focused decisions.

Get started with a VoC program with our starter kit linked below or request a demo of our leading Voice of the Customer Software today.

Other Customer Feedback Resources:

Free eBook: IDC MarketScape for Voice of Customer Applications Report